Pros

No hidden fees

Customizable parental controls for kids of all ages

No minimum age

Lots of value-adds for Greenlight Max users

Cons

All plans have a monthly fee

Savings rewards capped at $5,000 average daily balance

No credit-building for kids

Greenlight is a family-friendly money management app. It’s designed to teach kids age-appropriate financial concepts — how to earn, spend, and save responsibly. It puts kids in control of their finances without totally removing the parental leash.

Greenlight is comprehensive. App features include payment for chores, customizable allowance payments, real-time debit card spending alerts, and rapid person-to-person transfers between users. Greenlight’s reloadable prepaid debit card is accepted almost everywhere Mastercard is, with some important exceptions for age-inappropriate merchants. Higher-priced plans add a kid-friendly investing platform, identity theft protection, and more.

Wondering whether Greenlight is right for your family? Read on for more about its plans, features, and overall suitability for parents and kids.

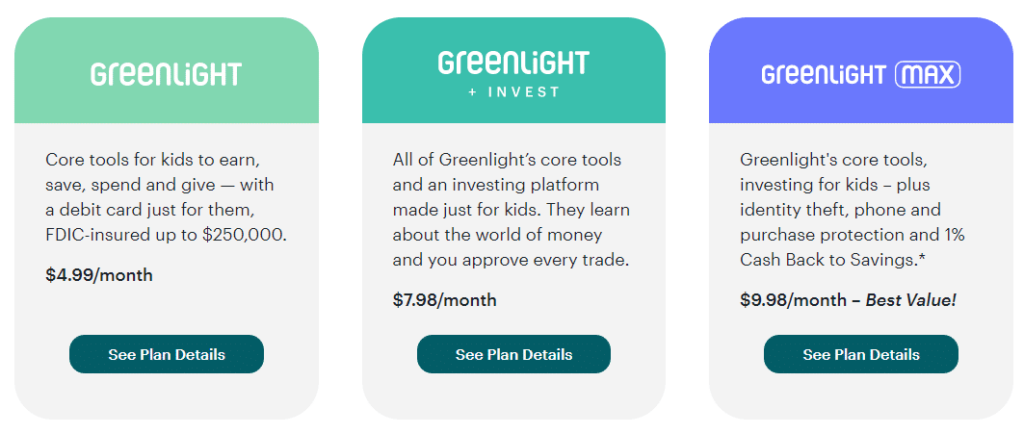

Greenlight Plans and Pricing

Greenlight has three reasonably priced plans: Greenlight, Greenlight + Invest, and Greenlight Max. Here’s how they stack up.

Greenlight

For $4.99 per month, Greenlight’s basic plan offers:

Debit Cards for Up to Five Kids

Your Greenlight plan comes with up to five prepaid Mastercard debit cards. Every card features:

- Mastercard Zero Liability protection

- FDIC insurance up to $250,000

- Protected savings balances

- Real-time kids’ spending notifications for parents

- App-based on/off controls (turn a card off or on with a tap)

- Option to log in with touch or face ID

- Instant transfers to kids’ debit cards

- Integration with mobile payment apps like Apple Pay and Google Pay

Note that while these cards function like checking accounts and have FDIC insurance, they’re not technically bank accounts.

Savings Round-Ups

You or your kids can set up Greenlight to round up debit card purchases to the next dollar and deposit the difference in savings — a great way to incrementally boost savings over time.

Parent-Paid Interest

You can boost your kids’ savings rate out of your own pocket with Parent-Paid Interest. Simply choose what you want your kids to earn on their savings balances and pay it out of your linked account.

Allowance and Chore Payments

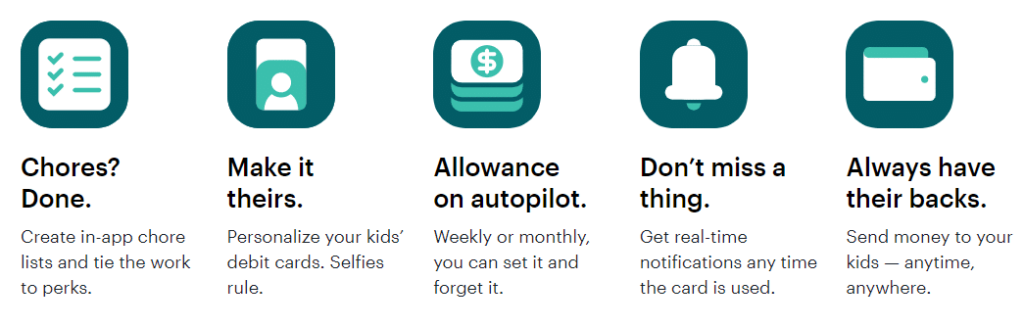

You can assign chores to kids in the Greenlight app and send payment once they’re complete or set up recurring allowance payments on a monthly or weekly basis.

Educational App for Kids and Parents

The Greenlight app comes with user-friendly educational modules that teach kids about basic financial concepts and empower parents to impart their own financial knowledge with confidence. Choose from articles, videos, quizzes, and more, all designed to boost financial literacy.

Core Financial Tools

Greenlight’s financial tools make it easy to manage day-to-day spending, set aside savings, and give back. Three distinct buckets help keep these three different types of funds separate. And kid users have discretion to set and work toward customizable savings goals.

Parental Controls

The Greenlight app comes with customizable parental controls that you can adjust as your kids grow. For example, you can choose exactly where your child’s Greenlight debit card is accepted, cap ATM withdrawals, and set category- or store-level spending limits.

Greenlight Savings Reward

On the basic Greenlight plan, protected savings balances earn a 1% savings reward (annualized). This reward applies up to $5,000 (average daily balance), after which savings balances earn no further rewards.

Greenlight + Invest

For $7.99 per month, Greenlight + Invest keeps all the features of the Greenlight base plan and adds:

Investing for Kids

Greenlight’s kid-friendly investing platform offers:

- A brokerage account held in the parent’s name

- A minimum balance of just $1

- Fractional share investing in eligible stocks

- No trading fees

- Parental approval for all trades

Note that securities held in the child’s account are registered to the parent owner. Because this isn’t a custodial account, neither ownership of the account nor individual equities transfers when the child reaches the age of majority.

Investing for Parents

Greenlight offers a separate investing option for parents. This is also a brokerage account held in the parent’s name, but it dispenses with parental approval for trades. As with the child’s account, this parent account is at the sole disposal of the adult owner.

Greenlight Max

For $9.99 per month, Greenlight Max keeps all the features of the two lower-priced plans and adds:

2% Savings Reward

Greenlight Max users earn an additional 1% savings reward on eligible savings balances for a total reward of 2%. The same $5,000 average daily balance cap applies.

Cash Back on Eligible Purchases

With Greenlight Max, your kids earn 1% cash back on eligible debit card purchases.

Priority Customer Support

Greenlight Max users qualify for priority customer support. If you need to get in touch with the app’s customer service team, you’ll enjoy front-of-the-line access.

Identity Theft Protection

Greenlight Max comes with complimentary identity theft protection for the entire family, not just kids. This includes:

- Identity theft monitoring

- Identity theft alerts

- Identity restoration

Cellphone Protection

Greenlight’s cellphone protection plan provides coverage for up to five phones. The policy covers damage, loss, and theft, subject to applicable coverage limits.

Purchase Protection

This benefit provides financial coverage for damage or theft affecting eligible items purchased with your Greenlight debit card, subject to dollar-value limits and other restrictions.

Additional Features of Greenlight

No matter which plan you choose, you can take advantage of these additional Greenlight features and capabilities.

Customizable Greenlight Debit Card

For a one-time fee of $9.99, you can customize your Greenlight debit card with a photo of your choice. It could be a selfie, a picture of your favorite pet, a stirring landscape or still life — whatever appeals to you.

Greenlight Gift

The Greenlight Gift feature makes it easy to send money to any Greenlight user, even if you don’t have a Greenlight account yourself.

International Transactions

You can use your Greenlight debit card abroad, almost anywhere Mastercard is accepted. International purchases don’t incur foreign transaction fees, although currency fluctuations may affect their actual dollar value.

Referral Program

Greenlight has a generous referral program that pays you and newly referred customers once they successfully sign up using your unique referral code. Referral bonuses vary and the program is subject to change at any time; see its terms for more information.

Million Bazillion Podcast

Greenlight’s Million Bazillion is a fun, age-appropriate podcast that makes basic and intermediate financial concepts accessible to Greenlight kids.

Advantages of Greenlight

Greenlight has some notable advantages, including transparent and fair pricing and lots of value-adds for users who upgrade to Greenlight Max.

- No Hidden Fees. Greenlight does have an unavoidable monthly fee. On the bright side, you’ll find no hidden fees here — the monthly cost is transparent, and there’s not much in the way of add-on costs other than the one-time fee for custom cards.

- No Minimum Age. Children of any age can participate in Greenlight. There’s no minimum age limit here.

- Customizable Parental Controls. Greenlight’s powerful parental controls let you set your child’s card spending limits down to the category and even store level. That’s much more control than you get with a traditional checking account.

- Payments for Chores and Weekly or Monthly Allowance. Greenlight makes it easy to assign chores and reward kids for getting them done — and to dole out weekly or monthly allowances via direct deposit.

- Investment Accounts for Parents and Kids. Greenlight + Invest adds investment accounts for parents and kids, although both remain in the parents’ name.

- Greenlight Max Users Get Cash Back on Eligible Purchases. As a Greenlight Max user, you’ll earn 1% cash back on eligible debit card purchases.

- Greenlight Max Users Get Identity Theft Protection and More. Greenlight Max comes with a bunch of potentially useful value-adds, including identity theft protection for the whole family and purchase protection for eligible items purchased with your Greenlight cards.

Disadvantages of Greenlight

Greenlight isn’t perfect. Its downsides include an unavoidable monthly fee and a cap on savings reward earnings.

- All Greenlight Plans Have a Monthly Fee. Greenlight doesn’t have a free plan. If you want to use it to boost your kids’ financial IQ, you’ll need to pay at least $4.99 per month. That’s more than reasonable for what you get, but you do have to pay for it.

- Greenlight Caps Savings Rewards at $5,000 Average Daily Balance. Greenlight offers a good interest rate on eligible balances — 1% to 2%, depending on your plan. Unfortunately, this rate — which Greenlight calls a savings reward — only applies to the first $5,000 in average daily balances each month. If your kid amasses more than that in their protected savings account, they won’t earn anything on it.

- Greenlight Doesn’t Offer a Credit Card. If you’re looking to build credit for your kids with an entry-level credit card or credit-building loan, Greenlight can’t help.

Final Word

Greenlight is a comprehensive money management app for kids and parents. With reloadable prepaid Mastercard debit cards for up to five kids, customizable spending controls and financial goals, and a host of value-adds in higher-priced plans, it’s a powerful tool for anyone who wants to give their kids a head start on the road to financial freedom.

Greenlight does have some drawbacks, like the lack of a free plan and no credit-building tools. But these are minor in the grand scheme of things. So why not sign up and see if Greenlight can make a difference for your family’s finances?

Pros

No hidden fees

Customizable parental controls for kids of all ages

No minimum age

Lots of value-adds for Greenlight Max users

Cons

All plans have a monthly fee

Savings rewards capped at $5,000 average daily balance

No credit-building for kids