Taxes

12 articles

State and local taxes in the U.S. add up to real money. There’s a huge difference between the highest-taxed states and the lowest. If you’re considering where to set down roots or looking to move to a lower cost-of-living area, read on to learn which states offer the lowest tax rates.

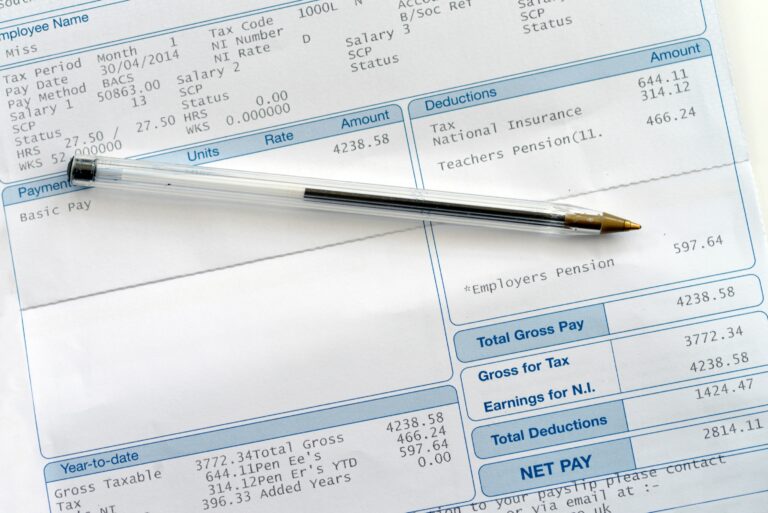

As tax forms go, the 1098, Mortgage Interest Statement ranks among the simplest as you prepare your tax return. But there are some things you need to know about Form 1098 and how to use it in your tax return.

Americans are on the hook for several different types of taxes throughout the year. Luckily, there are ways to reduce your tax burden and spread out the impact taxes have on finances. Here are five types of taxes you may be subject to at some point, along with tips on how to minimize their impact.

If you recently filed your tax return and were expecting a fat refund, you might be shocked to discover it’s no longer coming. There are several situations in which the IRS can legally seize your refund. So before crying foul, consider whether one of these situations applies to you.

An offer in compromise allows you to wipe out your tax debts for less than the full amount you owe. However, this option isn’t open to all taxpayers. The IRS considers offers in compromise only in certain circumstances. Find out if you qualify and if an OIC is right for you.

FreeTaxUSA’s tax prep software is one of the cheapest — free federal returns for all users, even those with complex tax situations. But it may not be right for all taxpayers. Before you jump at the price, ensure you understand how FreeTaxUSA works, including its advantages and disadvantages.

As you explore ways to lower your taxes as a real estate investor, add 1031 exchanges to your tax-shrinking toolkit. They can help you avoid capital gains taxes until you’re ready to sell off your portfolio. But first, learn how to use them effectively.

Liberty Online is a solid tax filing option for tax situations of virtually any complexity. However, it does have a significant disadvantage that’s worth noting: no free filing option. But it’s still worth checking out if you don’t qualify for free tax filing with most tax prep providers, anyway.

One lesser-known measure of income is your modified adjusted gross income. It impacts your ability to qualify for certain tax incentives or things like health care subsidies. Fortunately, your MAGI isn’t all that hard to calculate once you know what it is and why you’re trying to figure it out.

E-file.com is cheaper than full-service competitors, but it isn’t right for everyone. Before you sign up, carefully review its features, pros, and cons to ensure E-file.com is the right tax preparation software for your needs.

Taxhub blends the user-friendly interface of online DIY services with the expertise of in-person tax preparation services. But it may be better for some filers than others. Find out whether it’s the right service for you, whether you file individually or as a business.

TaxHawk is one of the few online tax preparation platforms with free federal filing for the vast majority of filers. But there’s a catch — it’s an entirely DIY process. But that doesn’t mean it’s not an excellent deal for those who can handle it.

Trending stories

Explore Manage Money

You’ve got it. Learn what to do with it.