Either you control your money, or your money controls you. And when you reach your 30s, it’s time to take your finances by the horns and wrestle control of them once and for all.

But if you’re like most Americans, your parents didn’t teach you much about smart money management. Nor are our schools teaching financial literacy; CNBC found that only 3% of U.S. adults can pass a basic financial literacy test. Which means you’re on your own to learn how to build wealth.

Here are 30 tips to master your money and end your 30s far wealthier than you entered them.

1. Pay Off Your Credit Card Debt

Credit card debt is notoriously expensive – and unnecessary. According to USA Today’s calculations, credit card companies charge an average interest rate of 16.71%, and some charge as much as 20% to 25%. Even the lowest-interest credit cards charge rates between 13% and 16%.

You would never borrow money at those rates to buy a house or car. Yet many consumers don’t hesitate to pay that interest on frivolous expenses like dinners out or another jacket to add to their collection.

If you’re putting charges on your credit card and not paying off the balance every month, you’re spending more than you can afford. According to Experian, the average U.S. household’s credit card debt is $6,354. Paying 16.71% in interest on that balance comes to $1,061.59 a year.

If you want to grow up financially, pay off your credit card balances and never charge more than you can pay off at the end of the month.

Pro tip: If you’re struggling with high interest rates, consider a personal loan through SoFi. This will help consolidate your balances with a much lower interest rate.

2. Fix Your Credit

Credit matters. Better credit will help you buy more house or car with less money. Consider the following scenario.

David has terrible credit. He wants to buy a house, but the only loan he qualifies for requires a 10% down payment, three mortgage points, and a 6.5% interest rate.

For a $250,000 property purchase, David would have to come up with $31,750 – $25,000 for the down payment and $6,750 in points. And that doesn’t include his other closing costs, such as title and legal fees. If he borrows $225,000 and his monthly mortgage payment is $1,422.15, he will pay $286,975.10 in interest over the course of his 30-year mortgage.

In contrast, Rebecca has excellent credit. She buys the house next to David’s for the same price of $250,000, but she qualifies for a 3% down payment, no points, and a 4% interest rate.

Rebecca only has to come up with $7,500 in cash. Her loan amount is higher at $242,500, yet her monthly payment is nearly $300 lower at $1,157.73. Over her 30-year mortgage, she’ll pay $174,283.55 in interest.

If your financial situation resembles David’s more than Rebecca’s, start with these seven steps to improve your credit.

Pro tip: Make sure you sign up for Experian Boost. This free program will allow you to use your payment history from utility bills to improve your credit score.

3. Create an Estate Plan

Your estate plan will change over time, but that’s no excuse not to have one.

Whether you’re single or married, have kids or no kids, the worst thing you can do to your family is leave them an enormous legal and financial mess to clean up while they’re already reeling from your untimely demise. Yet 60% of American adults have no estate plan, according to AARP. That includes older adults; imagine how much worse the statistics are for 30-somethings!

Create a will or living trust through Trust & Will. Hopefully, your family won’t need it for another 60 years, but if you die without one, they’ll face a lengthy list of legal headaches – not the legacy you want to leave behind.

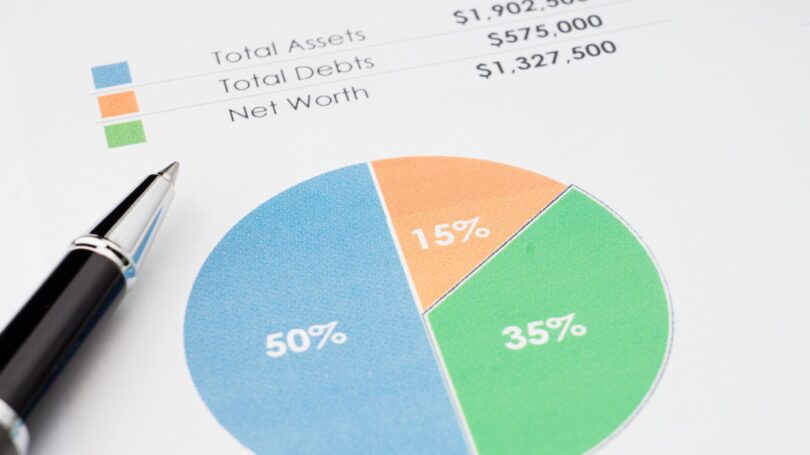

4. Start Tracking Your Net Worth

What is your net worth? If you can’t give an approximate answer without hesitating, that needs to change.

There are plenty of options available to help you track your net worth for free. For example, Mint will automatically track your account balances, debt balances, real estate values, and more and email you weekly and monthly reports on your spending and net worth. This helps make growing your wealth tangible and real, rather than nebulous and conceptual. You can also use a service like Personal Capital. This is what I use for my monthly budget, plus it lets me track my progress with my net worth.

Review your figures every month and keep funneling money into your investments. Don’t worry about the stock market’s fluctuations at your age; instead, focus on pumping as much money into building your net worth as possible.

5. Create an Emergency Fund

Some personal finance experts claim you should have six months’ or even a year’s worth of expenses in a cash emergency fund. Others find this excessive and the opportunity cost too high. But the underlying principle is sound: You should have money easily accessible for emergencies, and it should be enough to cover at least one or two months of expenses.

The sad fact is that 61% of Americans could not cover an unexpected $1,000 expense, according to CNBC. That means that the majority of Americans are living on the edge of a financial cliff because unexpected bills – from car repairs to medical bills to home repairs – pop up all the time.

Step away from the cliff’s edge and save up a few months’ expenses in an emergency fund. Ideally, you will keep this money in a high-yield savings account like CIT Bank, but if you don’t like the idea of keeping it all in cash, look for stable, liquid investments you can draw on in an emergency.

6. Get Serious About Your Health Insurance

In your 20s, you’re invincible. Bullets bounce off your skin. You’re immune to car accidents. Or so you think. If you’re ready to grow up, it’s time to get serious about your health insurance.

Assuming a health emergency won’t happen to you is a recipe for financial and physical disaster. Your next major health care bill might come five years from now, or it might come tomorrow. You need to be prepared for it.

Start by understanding some of the factors impacting health insurance premiums and choose a policy that makes sense for your family. If you’re single and healthy, for example, you may feel comfortable with a low-cost, high-deductible policy. Explore everything from an HSA from Lively to a traditional high-cost insurance policy. If your employer doesn’t provide health insurance, you still need coverage, which you can obtain through the Health Insurance Marketplace.

7. Consider Life Insurance & Long-Term Disability Insurance

Unlike health insurance, not everyone needs life insurance or long-term disability insurance. These insurance policies make the most sense for households where one partner earns the majority of the income and the household depends heavily on that partner’s ability to earn. If something happens to that partner, the family needs a backup source of income.

Explore multiple options, speak with several brokers, and start thinking about how much life insurance you need, if any. A great place to start is PolicyGenius. They will work with all the top insurance companies so you know you’re going to get the best rates.

8. Ditch the Status Car

Almost every 20-something I’ve ever met – yes, myself included – wants to prove to everyone around them how successful they are. And cars are among the most obvious ways to try to do it. But it’s time to get over status symbols and conspicuous consumption.

No one cares. Seriously, no one else is paying attention to what kind of car you drive. A Hummer, a Honda, a Hyundai – your friends and family don’t care. So get over yourself and stop overspending on a car. Start by considering a reliable, low-cost, functional used car.

9. Better Yet, Ditch Your Car Entirely

Cars are expensive. According to AAA, the average American spends almost $9,000 per year on each car they drive.

If you can, get rid of your car and instead walk, bike, take public transportation, or use car-sharing services like Zipcar or ride-hailing services like Uber.

If you live in the suburbs, this option may not be practical. That’s why my wife and I intentionally chose to live in a location that makes it possible for us to share one car.

10. Start Exercising Every Day

People scowl when I suggest this. But when I don’t exercise, I’m less productive in my work. And, since I’m self-employed, less productivity means less revenue.

Beyond making you feel more energetic and productive, regular exercise also helps you save money on health care. A joint study by Johns Hopkins, Yale, and several other universities demonstrates that adults without heart disease who exercised regularly spent $500 less on health care over the course of a year. Of adults with heart disease, those who exercised spent $2,500 less on health care each year.

You don’t need to run 10 miles every day. If the idea of exercise makes your nose wrinkle, try going for a brisk 15-minute walk around the neighborhood once a day. You can even listen to a personal finance podcast or an audiobook to keep you entertained and educated while you’re moving.

11. Listen to Personal Development Podcasts & Audiobooks

Whatever your profession, there are podcasts and books that can help you reach the next level in it. You can nab quick ideas for new marketing tactics from a five-minute daily podcast or deep-dive into 20 hours of an audiobook on a specific marketing strategy, for example.

I listen to podcasts and audiobooks for an average of an hour every day. I listen while I’m working out, while I’m brushing my teeth, or on long strolls on my neighborhood beach. Not all of them are educational – I love fiction too – but I get a tremendous ongoing education at almost no cost, in either time or money. Imagine how much more accomplished you could be in your field if you averaged a book every 10 days!

You can also use podcasts and audiobooks to learn about personal finance to help you build wealth faster and more efficiently. One of the first audiobooks I ever listened to was Robert Kiyosaki’s “Rich Dad, Poor Dad,” which is considered a classic for a reason.

You can find nearly any popular book in audio form through Audible. Better yet, check if your local library offers audiobooks for free through Overdrive. For podcasts, visit either iTunes or Stitcher to check ratings and reviews and find the best podcasts on whatever topics interest you.

12. Form an Income Strategy

Did you fall into your career, or did you strategically choose it?

Like many people, I fell into mine. I had no idea what I wanted to do with my life in my early 20s. In fact, it wasn’t until my mid-30s that I discovered it. But it turns out that your early career moves matter much more than you might think. According to a Federal Reserve Bank of New York study, nearly all of Americans’ income growth happens before age 35. After age 35, the overwhelming majority of Americans see virtually no growth in income. They “keep on keepin’ on” and effectively stall in their careers and incomes.

This report terrified me when I first read it, but there’s an intriguing exception to this trend: It didn’t apply to the top 10% of earners. The report analyzed decades’ worth of financial records and found that higher earners kept seeing their income grow over time. Which raises an important question: How do you make sure you’re the exception to this trend? Read on to find out.

13. Take Strategic Risks

If you don’t want your income to stall in your mid-30s, you need a clear strategy for how you will keep growing your income. It could be starting a side business, aggressively investing in equities or real estate, becoming a landlord, changing careers, or embracing more responsibility at your current job to get a raise. Each of these involves an element of risk, but they’re calculated risks based on real numbers, research, and contingency plans.

Regardless of your specific strategy, the important thing is that you have one and you execute it vigorously. Otherwise, expect to be earning the same salary when you’re 60. Playing it safe with career cruise control is exactly why most Americans’ incomes stall at 35.

14. Start a Side Hustle

If you’re entrepreneurial, there are dozens of side hustles you can start quickly and relatively easily to prevent income stagnation.

My friend Zack hosts food and beverage tours in Baltimore. It helps him earn some money on the side, but he also has fun with it. Often, his guests buy him drinks or give him tips. He’s also become friends with many local bars and restaurants, who ply him with free drinks and food.

No one said side hustles have to be tedious. Sure, you can drive for Uber. But why not get more creative and get paid for doing something you love?

15. Find a Hobby That Makes (or Saves) You Money

You’d be amazed how many hobbies can earn you money, rather than cost you money. I love skiing, scuba diving, and skydiving, but they’re expensive. I also love writing, and I get paid to do it.

Hobbies can also save you money. I used to brew beer, and while no one paid me to do it, I spent less on homebrewed beers than the craft beers I would have otherwise bought at the store. And while my buddies and I were brewing beers on a Saturday afternoon, we weren’t out spending $100 apiece at the golf course.

Start brainstorming all the ways you could make or save money doing the things you love, such as by selling crafts, teaching lessons, or sharing your expertise on a blog.

16. Marry Someone With a Similar Money Mindset

It may not be romantic, but if building wealth is important to you, you need to screen the heck out of your dating prospects to make sure their financial habits and goals align with yours.

This goes far beyond income. Incomes can change in an instant if someone loses their job and can’t find one at the same income level. People may also change careers into a lower-paying field. When my wife and I were dating, I had a six-figure salary. That changed when I decided I wanted to work for myself. (She’s only now starting to come around and forgive me.)

Instead of just looking at income, look at potential mates’ spending attitudes and financial goals. Do they want to live on half your household income to reach financial independence and retire by 40? Do they want to spend every possible penny on a big house in the suburbs and the latest and largest SUV? Would they rather spend $3,000 in discretionary savings on a trip to Italy or a new Italian sofa set?

Your spouse will be your financial partner for the rest of your life. If you want a healthy net worth – and a healthy marriage – make sure you and partner are aligned on money matters.

17. Having Regular Money Conversations With Your Spouse

What are your financial goals? What are your spouse’s financial goals? You may think they’re the same, but they probably aren’t as identical as you think. So, talk to your spouse. Share your goals and ask about theirs. Discuss your financial priorities and where you will spend your extra money.

Most of all, discuss what savings rate will you need to achieve to reach those goals. The higher the savings rate, the more you’ll both have to defer gratification. Sacrificing what you want today for what you want tomorrow isn’t easy, and when one partner is willing to make those sacrifices but the other isn’t, you need to talk it through until you both agree on a compromise.

These conversations are not always fun, but they’re necessary if you want a healthy, wealthy marriage. Use these basics of married money management to kick off your conversations.

18. Break the Money Taboo

Our society is afraid to talk about money. That’s a big problem because the free exchange of ideas is how we all learn and grow. When you don’t talk about something with your peers, you lose the benefit of their knowledge.

It’s like sex. When you were 20, you probably had no inhibitions about discussing sex with your friends, and you probably learned a lot from their experiences. But the older you get, the less likely you are to talk about sex, and the less exposure you get to new ideas or solutions to problems.

Talk to your friends and family about money. Don’t be tacky and brag, and don’t share exact income or savings numbers. Instead, talk about your financial goals and what you’re doing to reach them. Talk about the sacrifices you’re making so you can save more. Most of all, share ideas for budget hacks and ways to spend less without sacrificing quality of life.

19. Partner With a Budget Buddy

A joint study by economic researchers from Harvard, Columbia, and a Chilean team found that when people shared their economic goals and progress in small groups, their savings rate nearly doubled.

That’s a 100% increase in savings rate, simply from a little peer pressure!

Find a budget buddy or form a small group and share your financial goals with each other. Put them in writing, then meet once a week or once a month and share your progress. Have fun with it; meet over drinks, before watching a big game, or on a girls’ night. The important part is that you hold each other accountable.

20. Take Advantage of Matching Retirement Contributions

Some employers will match your retirement contributions up to a certain percent of your paycheck. It’s free money, and you’re crazy not to take it.

You’ll save more for retirement. You won’t pay taxes on it. And your employer will give you extra money, just for being responsible enough to save and invest. It’s a win-win-win. There are no caveats, and there’s nothing to debate; it’s as close to a no-brainer as financial decisions get.

Pro tip: If you’re currently investing in your companies 401k plan, make sure you sign up for a free analysis through Blooom. They will help you understand if your investments have the proper diversification, the correct asset allocation and that you aren’t paying too much in fees.

21. Consider Maxing Out Your Roth IRA

When you contribute money to a traditional IRA, it’s tax-free now, but when you withdraw money in retirement, you pay taxes on it. When you contribute money to a Roth IRA, you still pay taxes on it now, but it’s tax-free in retirement, even if it grows by 1,000% between now and then.

You can split your retirement contributions, putting some into a traditional IRA and some into a Roth IRA every year. But there are two important advantages of a Roth IRA that are worth mentioning. First, you can use your Roth IRA funds to buy a house, penalty-free. Second, you can use your Roth IRA to pay for your children’s college tuition, again penalty-free.

Or, of course, you can use it for retirement, which was its original intention. That makes your Roth IRA incredibly flexible and a great place to park money if you don’t know your exact future financial needs.

22. Always Roll Over Your 401k

There’s a key distinction between an IRA and a 401k: Your IRA is attached to you personally, while your 401k is attached to your job. That means when you leave a job, you should move your money out of your employer’s 401k program and into either a new employer’s 401k program or your IRA. In accountant-speak, this is called “rolling over” the funds.

If you leave your old 401k behind, you’re likely to forget it’s there. If you liquidate it, it will be treated as a distribution, and you’ll be hit with hefty penalties. For example, a $10,000 original balance could drop to $7,000 after taxes and penalties.

A study by ING Direct found that half of Americans in their 20s who changed jobs left their 401k accounts behind. To avoid this, create an IRA, and the next time you change jobs, roll the funds into it. Otherwise, your savings may be for naught.

23. Get Comfortable Investing in Stocks

Does stock investing make you nervous? If so, you’re not alone. Some people panic just thinking about the volatile acrobatics the stock market performs.

Others find stock investing scary because they don’t know much about investing. They don’t know how to evaluate companies, pick stocks, time the market, or use stock screeners. It’s all a foreign language to them.

Stop sweating about stocks. You don’t have to be an equities guru with historical data on PE ratios or a list of buy/sell indicators. Instead, just put money in every month and buy a handful of index funds that track the major market indexes. Aim for a couple of U.S. funds that track indexes like the S&P 500 and the Russell 2000 and a couple of foreign indexes that track European, Asian, or emerging markets. Over time, they’re almost sure to go up. Sign up for an account with M1 Finance and you can be on your way pretty quick.

Check out these stock market investing tips for beginners to help you get started.

24. Stop Justifying Your High Housing Payment

I love real estate. Most of my career has been in real estate. But it makes me sick when I hear people say, “Well, we’re spending more than we’d like on our house, but it’s an investment!”

Let me be very clear: Your house is not an investment unless you’re house hacking and it pays you every month. A rental property is an investment. A property you’re flipping is an investment. But your home doesn’t make you money; it costs you money. It’s a bill, like any other bill.

Is your car an investment? Are your groceries an investment? No, they’re bills. They may be necessary expenses, but they’re still expenses. In other words, they’re things that make you poorer, at least for the foreseeable future.

You might get lucky, and the market may appreciate between now and when you feel like selling. Or it may not. You have no control over the market, and it could turn on you at any moment. And don’t assume you can force equity with home improvements; Remodeling Magazine analyzed the return on investment for major home improvement projects and didn’t find any that raised home values more than they cost.

Instead of pumping money into your house and then justifying it to yourself as an “investment,” look for ways to spend less on housing. Or, better yet, house hack and live for free.

25. Set a Retirement Target Date & Amount

How much do you need to retire? When do you want to retire? These are simple questions, and the answers are just as simple. But if you don’t know those answers, you need to find them.

Start by understanding the concept of safe withdrawal rates to help you answer the first question. Once you know how much you need to retire, you can use free retirement calculators to tell you exactly how much you need to save every month to reach that nest egg. Try AARP’s retirement calculator for step-by-step guidance or Calculator.net’s retirement calculator to jump right in with the numbers.

26. Consider FIRE

FIRE stands for financial independence and early retirement. The concept is simple: Instead of spending most of your paycheck now and working 40 or 50 years, you spend a fraction of your income and invest the rest into savings and investments. Rather than retiring after 40 or 50 years, you retire after 5 or 10 years.

Yes, this involves sacrifices. You won’t be able to buy a McMansion like all your friends or parade around a designer hybrid-breed dog. FIRE isn’t for everyone, but if you’d rather untether yourself from a job sooner than later, it can be a fun and rewarding alternative to the norm.

27. Stop Going to Bars & Restaurants for Entertainment

I know how tempting this can be. I spent plenty of time in bars and restaurants in my 20s (and more than I care to admit in my 30s). But these businesses significantly mark up food and drinks to earn a profit. Stop stuffing money into their pockets and keep it for yourself by meeting friends and family anywhere other than a commercial establishment.

You could host dinner parties, potlucks, barbecues, or game nights. One of my favorite activities with friends is a beach bonfire, complete with a picnic dinner and beverages. These events cost a fraction of what it would cost to meet at bars and restaurants, and you can enjoy the same quality of beverages, food, and company.

28. Curb Your Lifestyle Inflation

When the average person gets a raise, the first thing they do is go out and find a way to spend it. Not just one time, such as celebrating with friends; no, they find a way to spend it every month. They get a flashier car or move into a bigger or better house. They go out for more fancy meals. It’s called lifestyle inflation, and it’s insidious.

Once you’ve opened up an account with Personal Capital and set a budget, freeze it. As your income rises from those clever income growth strategies you’ve started working on, your mission is simple: Don’t let your expenses rise along with it. It’s easier said than done, but if you’re serious about building wealth, this is one of the tricks to do it.

29. Automate Your Savings

A recurring theme throughout this list has been spending less and saving more. When you think about it, that’s the crux of personal finance. But discipline will only take you so far. If you leave all that money just sitting in a checking account or connected savings account, sooner or later, you’ll be tempted to spend it. The trick is to get these savings out of sight and out of mind without you having to lift a finger.

One option is to have your employer start splitting your direct deposits. Have them put some of each deposit into your checking account for your monthly living expenses and the rest into a savings account or investment account of your choice – preferably at a different bank so you don’t see the balance every time you log into your online banking.

If your employer can’t split your direct deposits, set up automatic bank transfers to take place every two weeks when you get paid. Money arrives in your checking account, and within 24 hours, it’s automatically sent to your savings account where you won’t be tempted to spend it.

Another option for automatic savings is through Acorns. They will round up every purchase you make and the difference will be automatically transferred into an investment account.

30. Keep It Simple, Stupid

Personal finance is actually pretty simple: Spend less, save more, and invest your money where it will work hard for you. To take control of your finances, start by asking yourself some appropriately simple questions:

- What are my financial goals?

- What do I need to save every month to achieve them?

- Do I want to invest in anything more adventurous than index funds? If so, what?

Put a certain percentage of your savings into tax-protected retirement accounts, such as an IRA or 401k. Put the rest of your savings toward your other financial goals. The key isn’t learning nifty financial tricks, although they can help. The key is steadiness: keeping up your high savings rate and investments, month in and month out.

Final Word

If you’re anything like me, you saw plenty of financial peaks and valleys in your 20s. One month, you were up, living large, throwing money around, and trying to show off your success without being obvious about it. The next month, you were chagrined as your fortunes flipped.

As I near the end of my 30s, I regret not learning these lessons earlier. But learn them I did, and barring any unforeseen catastrophe, I will exit my 30s far wealthier than I entered them because of these money moves.

What money moves have you made in your 30s? Are you planning to make any changes?