Pros

Low fixed rates

Transparent, flat-rate pricing

No title search or appraisal required

Cons

Short draw period

Significant property type limitations

Limited customer service

For decades, little has changed when it comes to how homeowners borrow money. So it’s impressive to find a tech-oriented lender that’s truly disrupting the home loan industry.

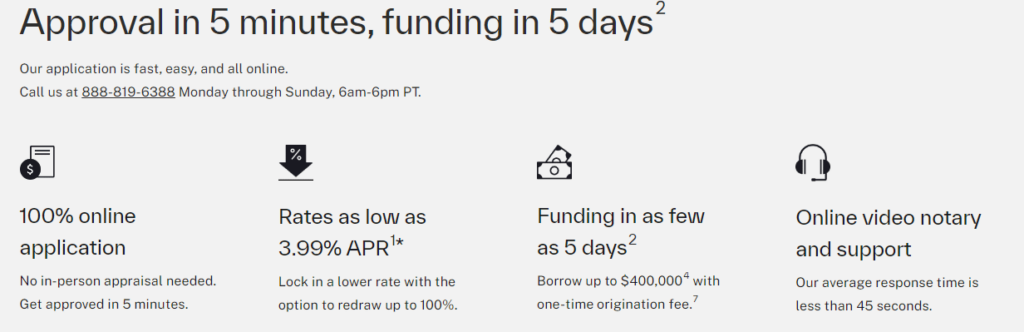

Founded in 2018, Figure uses blockchain technology and artificial intelligence to approve home loans in minutes and fund them in five days. Anyone who’s ever borrowed a mortgage or home equity line of credit (HELOC) knows that the traditional loan-closing process takes much longer than that — usually 30 to 60 days.

Figure’s primary service is a hybrid home equity loan and line of credit. Here’s what you need to know about it, including how Figure differs from traditional home lenders.

Figure Home Equity Line

Before explaining what Figure offers, it’s worth pausing to summarize the difference between traditional home equity loans versus HELOCs.

A home equity loan is a mortgage — usually a second mortgage — against your existing home with a fixed loan amount and fixed term. In contrast, a HELOC is a rotating line of credit that homeowners can draw on as needed, up to a maximum credit limit.

Technically, Figure’s Home Equity Line is a HELOC. But it includes some unusual limitations on credit line draws and isn’t as flexible as a typical HELOC. Borrowers can draw up to the original loan amount repeatedly during the draw phase (the first two to five years).

Figure’s Home Equity Line enables you to take out a loan ranging from $15,000 to $400,000 against the equity in your home. Figure allows a maximum combined loan-to-value ratio (CLTV) of 95%, which is high by industry standards. But your personal limit depends on your credit score and Figure’s lien position.

Figure’s loan terms are five, 10, 15, or 30 years, which you pay back on a fixed payment schedule. There’s an initial draw phase between two and five years, depending on your loan term. During this time, you can draw extra money from Figure if you wish.

Figure’s Home Equity Line is available in most states plus the District of Columbia, and the program is expanding each year. For a list of available states, see the footer at the bottom of Figure’s site.

Figure Home Equity Line — Application Process

Figure’s application process is fast and efficient. Here’s what you can expect when applying for a Home Equity Line from Figure.

Step 1: Complete the Prequalification Form

To begin the process, fill out Figure’s online prequalification form. They only ask the bare minimum to make sure you qualify:

- Name

- Address

- Email address

- Date of birth

- Collateral property address and type of property

- Purpose of the loan

- Household income

Next, Figure performs a soft credit check. They require a minimum score of 620 in most states, and 720 in Oklahoma. If you qualify, they quote you an origination fee, interest rate, and maximum loan amount.

Step 2: Submit the Full Loan Application

If you like the quote you receive, you can proceed with the complete application, which also only takes a few minutes. Figure asks you for:

- Photo identification — a driver’s license, passport, or other government-issued photo ID

- Bank account access

- Proof of homeowners insurance or landlord insurance

- Proof of flood insurance if the home is located on a flood plain

Once you submit the full application, Figure’s automated system verifies several key pieces of data.

First, they run a hard credit inquiry to confirm your credit score. Their system then checks your bank account’s transaction history for deposits in line with your stated income. They also check public records to verify that you’re listed as the property owner.

Most applicants receive a final approval within five minutes. In some cases, Figure may request additional documentation if their automated system can’t verify certain data.

Over the next few days, Figure’s human team reviews the automated data points and makes sure everything looks correct. They pay particular attention to verifying the automated property value to avoid overlending.

Step 3: Virtual Closing

Figure uses an innovative “eNotary” system for handling settlement. You hop on a video call with the eNotary, who verifies your identity using a combination of verification questions and comparing your face to your photo ID.

From there, it’s merely a matter of e-signing the loan documents: a note (or promise to pay) and a lien against the property. The eNotary then digitally notarizes your e-signed documents, and just like that your loan is official.

Step 4: Funding

Figure already has your banking details, so they deposit the funds electronically in your checking account. Wire transfers only take minutes or hours to transmit, not days, so like the rest of the loan process, it happens fast.

Advantages of the Figure Home Equity Line

Figure’s Home Equity Line offers some unique advantages over traditional home equity lenders and HELOC programs.

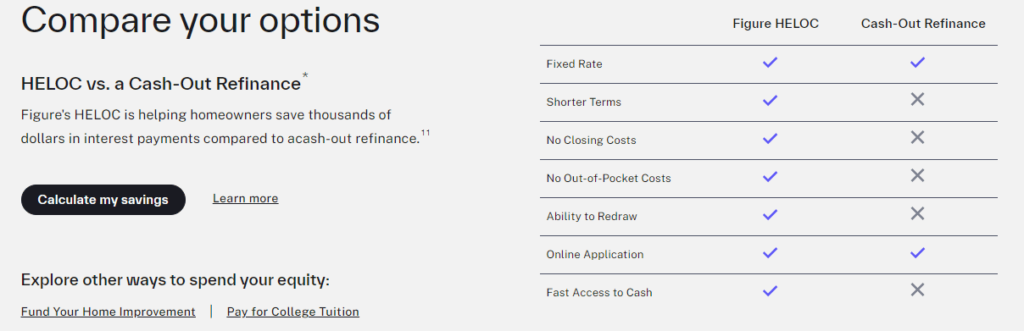

- Fixed Interest Rate. As a rotating line of credit, HELOCs historically charge variable rates that fluctuate along with market rates. Figure breaks the mold and offers a HELOC with a loan term of up to 30 years and a fixed interest rate. And these fixed interest rates are competitive, with annual percentage rates (APRs) ranging from about 4% to about 15%. Keep in mind that APR includes closing fees, not just interest on the loan.

- Transparent Fee Structure. With a traditional mortgage or HELOC, the lender charges thousands of dollars in fees, including origination fees (points), processing fees, underwriting fees, courier fees, and “junk fees.” Figure charges one single origination fee, which you pay upfront when you take out the loan. There are no other fees, not even late payment fees if you miss a payment. Figure does not charge a prepayment penalty if you pay off the loan early.

- No Appraisal or Title Search Required. Figure doesn’t require you to pay for an appraisal. They use an intelligent algorithm to determine your property’s value through their own Automated Valuation Model. It’s one reason they can close and fund so quickly. In true “disruptor” fashion, Figure doesn’t even require a traditional title search, which can save you thousands of dollars on title company fees.

- Fast Settlement. Even hard money loans rarely settle within five business days. The fact that Figure can fund consumer home loans that rapidly is almost miraculous. Figure approves most applications automatically within five minutes. No human interaction is required; their algorithms analyze and approve your loan. And the settlement is also done remotely from the comfort of your home, office, or favorite coffee shop.

- Soft Credit Inquiry to Prequalify. When prequalifying you for a personalized interest rate and origination fee quote, Figure makes a soft inquiry on your credit. That means there’s no ding to your credit score. Most loan officers press you for permission to run your credit before offering a firm quote on interest and fees. Only if you decide to move forward with your loan application does Figure run a hard credit inquiry.

- Second Homes and Investment Properties Allowed. Few home equity lenders allow HELOCs against investment properties and second homes. But Figure does. Just don’t expect the pricing or CLTV to be the same. For second homes and investment properties, Figure charges more in interest and origination fees, and you can expect a lower CLTV as well. Figure also requires a higher minimum credit score of 680 when you borrow against an investment property, but that’s industry standard.

- Revised Draw Limit. The main advantage of a HELOC is flexibility. You borrow money against your line of credit, pay it back, and then when you need more money, you draw on it again. Figure historically only allowed borrowers to draw up to 20% of their original loan balance. If you borrowed $20,000, for example, the most you could ever draw against your credit line was $4,000, even if you pay off your original loan entirely. But in late 2020, Figure overhauled its HELOC draw limits to allow borrowers to repeatedly draw up to 100% of the original loan amount. That makes Figure’s HELOC far more flexible, and a true HELOC rather than a home equity loan with a top-off option.

Disadvantages of the Figure Home Equity Line

Figure’s program is not without its downsides, of course. Before you apply for their Home Equity Line, make sure you understand these drawbacks.

- Customer Service Limitations. Automation is great for fast approval and funding, but what if you want to speak with a human being? Unlike going through a traditional mortgage or HELOC lender, there’s no series of phone calls with a Figure loan officer. Figure does offer live customer service, through both online chat and a toll-free phone number, as well as email support. But you don’t have the option of face-to-face interactions with Figure like you do with a local bank or credit union.

- Short Draw Phase. The draw phase of Figure’s Home Equity Line only lasts two to five years, depending on the loan term. In contrast, many 30-year HELOCs offer a 10-year draw phase before rolling over to a 20-year repayment phase. Figure’s short draw phase is better than no flexibility at all but pales in comparison to a true HELOC.

- Property Limitations. Although Figure does lend against second homes and investment properties, they impose plenty of other limitations on collateral property. They allow detached single-family homes, townhomes, condominiums, and planned unit developments (PUDs). They do not allow multifamily properties — even two- to four-unit properties classified as residential. Nor do they allow manufactured homes, log homes, earth or dome homes, co-ops, mixed-use buildings, or commercially zoned properties.

Figure Mortgage — Purchase and Refinance Through Homebridge

In addition to a HELOC, Figure also offers a traditional home loan product through Homebridge, a lending partner. You can get purchase loans and mortgage refinance loans here.

Why Buy or Refinance With Figure and Homebridge?

Figure brings the same streamlining to their refinance and purchase program that they offer with HELOCs.

The application process is all online and you can complete it in minutes, including automated verification of income and assets. You’ll get a rate quote nearly instantaneously without a hard credit pull to ding your score.

Best of all, the loan can settle within 10 days — lightning fast compared to conventional mortgage lenders, who often take a month or longer to settle. And settlement takes place electronically, just as with the HELOC.

Already own a home and wondering whether it makes sense to refinance?

Homeowners refinance their mortgage for many reasons: debt consolidation, a lower interest rate, or to pull equity out of their home for other significant expenses like home improvements, college tuition, or real estate purchases.

The main advantage of refinancing your mortgage is that it tends to be cheaper than other forms of borrowing because your primary residence secures the loan.

Figure and Homebridge — Loan Parameters and Drawbacks

Figure offers up to 80% loan-to-value ratio (LTV) for refinances solely to lower your interest rate, with a maximum loan amount of $1,500,000. For cash-out refinances, Figure allows up to 75% LTV on a $1,000,000 loan amount. Only single-family homes and townhouses qualify, and Figure doesn’t issue mortgages against second homes or investment properties.

All refinances come with some inherent drawbacks, however. Closing costs — including lender fees, title fees, and recording fees — usually total thousands of dollars.

Refinances calculate points based on the entire loan amount, which is typically far higher in a refinance than a HELOC because you have to pay off your current mortgage as part of a new loan.

They also involve extending your debt horizon and restarting the amortization schedule from scratch, which means reentering the high-interest beginning phase of a mortgage loan.

Figure Pay

Most recently, Figure has launched Figure Pay, a payment app that functions similarly to PayPal. You can send money to friends or family, make purchases online, and access credit-building loans (Figure Pay Credit Loans).

With a physical Visa card, you can also make purchases with merchants in person wherever Visa is accepted. To withdraw physical cash, you can access over 55,000 ATMs around the country with no fee. And Figure has negotiated rewards with hundreds of retailers to incentivize paying through their app.

Other benefits of Figure Pay include:

- No transaction fees, ever

- Get a $100 bonus when you open your account, set up direct deposit, and receive at least $1,200 in monthly direct deposits for two consecutive months

- Get paid up to two days early with direct deposit

How Figure Stacks Up

Figure is arguably the most innovative home equity provider on the market right now, but it’s certainly not the only one. It competes against a slew of other companies, some with much better brand recognition.

One such competitor is Discover Loans, an arm of banking giant Discover Bank.

| Figure | Discover Loans | |

| Borrowing Limit | Up to $400,000 | Up to $300,000 |

| Maximum LTV | Up to 95% | Up to 80% |

| Term Length | Up to 30 years | Up to 30 years |

| HELOC or Installment Loan? | Hybrid | Installment loan |

Final Word

If you want the best of both a home equity loan and a HELOC, Figure’s Home Equity Line could be a perfect fit. It’s fast, transparent, and more flexible than a traditional home equity loan.

Just don’t expect in-person customer service or a lollipop for the kids. Your loan will be mostly automated with minimal human interaction. Call it the price of progress, or at least the price of speed and affordability.

Pros

Low fixed rates

Transparent, flat-rate pricing

No title search or appraisal required

Cons

Short draw period

Significant property type limitations

Limited customer service